In any investment, asset prices fluctuate, and those fluctuations are unpredictable. In this article, we will only focus on the portion of the fee we need to pay before investing. For example, if there are two cars of the same model, color, and performance, one dealer sells them for $120,000 without any additional fees; the other also sells them for $120,000, but charges an additional $3,000 in advertising and marketing fees. I don't think anyone would choose the second one. The same applies to fund products. Funds are the favorite of most amateur investors and many professional investors. While some fund products are similar in composition, their prices can vary widely. This is because of the expense ratio.

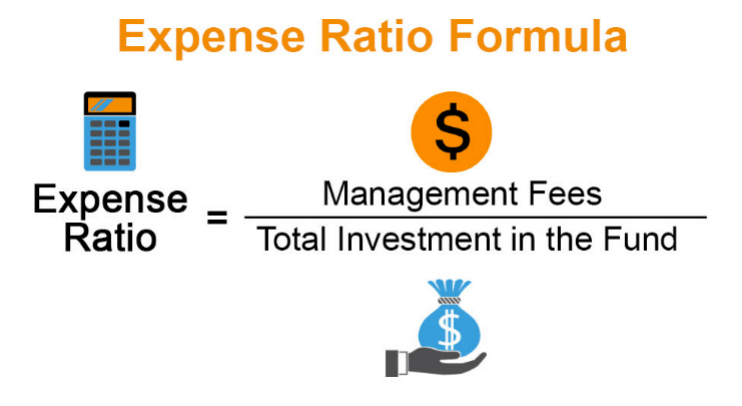

Generally speaking, the price of a fund is higher than the price of its constituent assets, which is understandable, since setting up a fund also costs money. A company needs to register the fund it sets up and hire a fund manager to manage it, all of which entails a fee. So how much does this cost? The Securities and Exchange Commission requires fund issuers to publish their annual operating expenses, separate the various expenses by category (e.g., management fees, distribution fees) and then aggregate them under the "Total Annual Operating Expenses" column, also known as the expense ratio. That's what you need to pay in addition to the fund's value.

It's not difficult to compare expense ratios across funds. Before you buy, the fund company will refer to the expense ratio disclosed by other funds to tell you what the minimum expense is. If you think that all funds have roughly the same expense ratio, you are dead wrong.

Difference in Yield

The difference in expense ratios isn't just in numbers, it can have a significant impact on your bottom line. Suppose you want to invest $5,000 in each of the two funds. The first fund requires you to pay a fee of $284 first, while the second fund only requires you to pay a fee of $1. It is true that there may be multiple fund products under the same issuer's name, and the expense ratio of each will be different, but no one is willing to pay an extra $284 for holding a fund.

The expense ratio of 5.68% and 0.02% seems to be a significant difference now, so what kind of difference will this bring in ten years’ time? Assuming that each fund has a nominal 10% annual return (before fees), there is no difference between the two funds if you ignore the expense ratio.

But now with the expense ratio, the difference between those two funds would be huge. Invest $5,000 in a fund with an expense ratio of 5.68%, and the fund will become $7,632.13 after 10 years; whereas if you invest in a fund with the same annual rate of return but an expense ratio of 0.02%, it will become $12,945.15 after 10 years (70% more than the former). Compound interest is indeed the most powerful in the universe!

Summary

When choosing an investment fund, you can first study its constituent assets, and then consider your investment goals, such as growth rate and rate of return. Of course, the expense ratio should never be overlooked. It is probably the most undervalued factor in all types of investing.