Residual income has emerged as the primary objective among people seeking to ensure financial security. Real estate is one of the most promising methods for creating a stable income without further direct participation. Walking around, one can quickly come across an individual or several individuals who generate income from rented real estate properties. Understanding these facts correctly can help you learn how to achieve this.

Investing in Rental Properties

Purchasing one or multiple houses and renting them out is one of the most traditional and standard methods of making passive income in the field. Other investments where you can invest your Money and get a fixed monthly income include buying houses for residential or commercial use and then leasing them. Property location for renting out should be controlled well in areas that are most demanded such that tenants should be many and often, reducing the many empty units and high yields. Maintenance and proper tenant management also lead to an increment in the profits achieved.

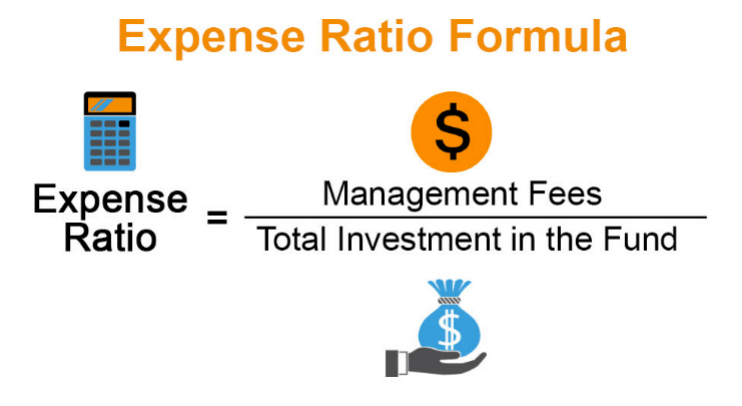

Real Estate Investment Trusts (REITs)

With REITs, you can participate in real estate investment without going through the standard acquisition procedures. They work in tandem with mutual funds, collectively assembling Money to purchase and develop income-producing real estate properties. The REITs pay dividends occasionally, so it is an exceptional method of generating passive income with little interjection. These investments also help diversify your profiles and mitigate bad risks connected with specific assets.

Short-Term Vacation Rentals

Companies such as Airbnb have taken the concept of short-term rental of a house for holidays to greatness, thus making it easier to earn someone's passive income through the real estate business. Emphasizing the tourist infrastructure of the object, one stock up on considerable profits. The cost of advertising and coordinating the listings might seem very high at first glance, but getting a property management service saves a lot of time & effort that would otherwise be used in the process. It can transform a property into a most effective asset since it simplifies the management of the property.

House Hacking

House hacking is an excellent strategy combining income generation from rental properties and eliminating housing expenses. This strategy means buying a property with several units and occupying one of the units while the other(s) are rented out. Rental incomes usually pay the mortgage, taxes, fees, and other costs, leaving the owner with some cash flow.

Investing in Real Estate Crowdfunding

This makes crowdfunding platforms a way of generating passive income from real estate through smaller outlay. They are marketplaces where the property developers or managers looking for capital for their projects meet the investors. Once the projects produce revenues, investors are allocated a fraction of the project revenues. It is a good entry point for people who want to make Money as they employ minimal capital.

Buying and Holding Appreciating Properties

Buying buildings within developing markets causes substantial returns to be made in the long run. You can keep these properties until their value rises and you decide to sell and get a profit or let them out for rent. The forecasted developments provide a general guideline showing where investments could prove most profitable for the business.

Leveraging Property Management Services

Managing investment portfolios, especially property investment, can be very challenging; however, this can be utterly passive through engaging property management firms. This involves managing the tenant's concerns, the property, and its collection of rents, so exercising real estate generates passive income without direct participation. Even though they will be hired, people are willing to pay for it since it saves them time and is more convenient.

Conclusion

It is possible to earn passive income through real estate, proper planning, and hard work. It can be as simple as owning rental houses or as complex as investing in REITs or via the relatively new-age crowdfunding technique. Depending on the chosen strategy, achieving the intended goal and gradually strengthening the financial base to receive permanent income is possible.