Saving for retirement is one of the critical financial aims people can set, and the proper choice of shares is one of the main tasks. Diversification helps manage significant risks because your Money is invested in different properties. Investors must know specific strategies to start a low-risk retirement IRA or 401K plan diversification.

Understand Asset Allocation

That is a fundamental question that needs to be resolved before any person can think of diversifying their retirement funds is where. Portfolio diversification occurs through different apportionment fields, including equities, fixed-income securities and property. This is because other investment classes carry different levels of risk and potential returns; thus, a diversified investment will lower the risks involved. Equity has relatively higher returns but higher risk, while fixed-income securities have relatively lower returns but relatively lower risk. Asset diversification is a critical factor in diversifying your retirement investment.

Invest in Multiple Sectors

Competitive diversification is as crucial as asset diversification across and within given classes. For example, there are subcategories you can directly get involved in when they involve the market of stocks, such as technology, health, and energy. Every sector has its response to market situations, meaning that your portfolio can be protected from a specific sector's poor performance. Diversification across industries makes your portfolio relatively safe depending on the performance of a given sector during retirement saving recovery.

Consider International Investments

Although most investors might limit their operations to domestic companies, adding international options can increase the involvement of retirement plans. For this reason, it's typical for global markets to show different results from domestic markets, which can offer much-needed growth when local markets are not doing well. Another possibility is an international stock, bond, or mutual fund investment, which can be a great addition. Understanding how to incorporate international exposure into your retirement diversified portfolio will increase growth prospects while managing risks.

Introduce Clause Concerning the Alternative Investments

It is essential to understand that stocks and bonds remain the core of most portfolios, but there are other classes of assets. These include real estate, commodities, or even private equities. For instance, real estate investment is usually considered stable during inflation, whereas commodities investments can be very stable. Introducing these options can help diversify your retirement investment since it occurs outside the regular markets.

Use Low-Cost Index Funds

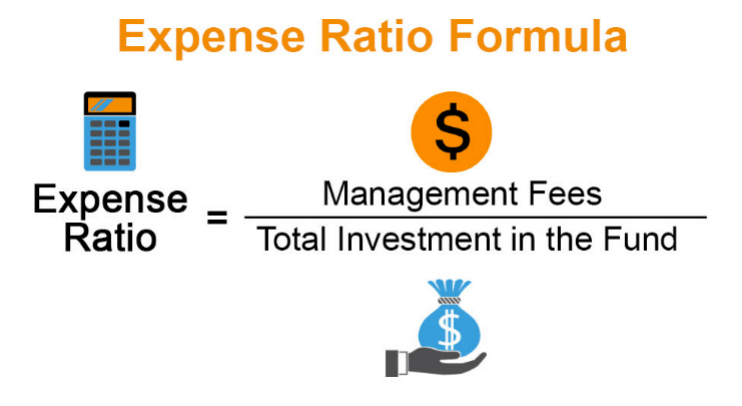

The second strategy of diversification for your retirement into different sources of income involves investing in index funds. These funds mimic a particular market index, like the S&P 500, and they can cover a lot of stocks or bonds. Since index funds are customized to invest in a large pool of companies, diversification is an easy and cheap method of minimizing risk. This also means they attract lower management charges than actively managed portfolio funds that assist in portfolio growth.

Rebalance Regularly

The exposure to your retirement investment plan might alter as market conditions arise. To achieve this favourable portfolio diversification, you need to rebalance it periodically to ensure you stick to the diversity levels of your choice. This involves realigning the investment portfolio to maintain the proper balance among other investment types. It aids in 'locking in' advances from well-performing assets and 'flexing' to identify and recycle capital to other areas that may seem lagging. Being consistent in rebalancing is very important when viewing the process of diversifying the retirement portfolio in the future.

Conclusion

Understanding how to manage your retirement investment portfolio is crucial in wealth creation, management, and minimizing risks. Suppose you formulate a suitable asset allocation program and ensure you are invested in various sectors, engaging in international and non-conventional markets. In that case, you will likely shun away from the fluctuations other investment vehicles might be experiencing. It will also assist in managing your retirement plan well and ensuring that your investment portfolio is always balanced. Diversification keeps your financial prospects secure when planning for the post-working years or in times of retirement.