Passive funds are called "index funds", which refer to selecting specific index constituent stocks as investment objects, not actively seeking to outperform the market, but trying to replicate the performance of the index.

This item includes two concepts: one is index and the other is fund. An index is an indicator compiled by a stock exchange or financial services institution that reflects changes in stock market prices and market conditions. Simply put, the essence of an index is a basket of stocks.

To better understand this concept, let’s look at an example:

John's wife waited for the June shopping festival for its annual discount and added all the things she wanted to buy into the shopping cart. John bought things according to the list in the shopping cart. This kind of fund that does not need to use his own brains to choose what to buy is a passive fund, also called an index fund.

What is an index-enhanced fund?

That is, while paying according to his wife's shopping list, John also compared the prices of some of the products in various stores. When you buy things, you add a little bit of your own ideas. Funds that you buy with a bit of your thinking are called index-enhanced funds.

The goal that John pursues is of course to buy everything his wife wants to satisfy his wife, but at the same time he also wants to show his smartness in front of his wife and spend less money to buy everything she wants. In professional terms, it is called "the goal is to earn above the benchmark while closely tracking the benchmark."

In fact, we have been seeing many eyes-catching titles, like "100 must-read books before the age of 30". When you buy books based on this kind of list without your own thinking, the logic behind is just like that of index funds. The difference between the index and booklist is that the index is compiled by an authoritative department, while the booklist may sometimes be misleading.

Index funds have the following advantages:

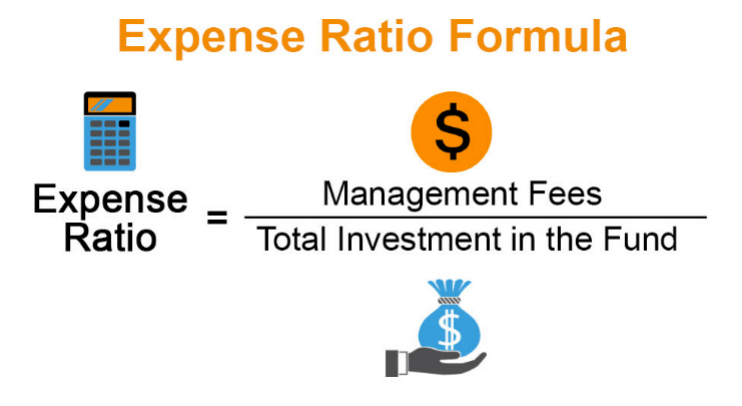

1. Low rates. Low rates mean low costs, and the lower the costs, the greater the profit margins.

2. The stock holdings are transparent. They are all written according to the compilation rules, so it is very clear.

3. Sustainability. As long as the securities market exists, index will always exist.

4. Stability. Each index will follow a fixed frequency every year, and exchange positions once or twice a year. Every time the position is adjusted, it needs to be adjusted according to the compilation rules, so the changes will not be particularly large.

Indexes in the market are divided into multiple series, and in each series, the index is further divided into scale index, industry index, style index, strategy index, etc. To put it simply, if you don’t know what stocks to buy, but you have a sector or industry that you are optimistic about, you can usually find the corresponding index.