As the world of cryptocurrency continues to grow, investors face an important choice either decentralized exchange (DEX) or centralized exchange (CEX). Both of them have their own advantages and disadvantages but familiarizing themselves with their functional differences helps in making suitable trade choices. Whether you’re new to crypto or an experienced trader, this guide will break down the fundamentals, risks, and rewards of both exchange types. This blog article will talk about the practical skills you'll need to use DEX and CEX effectively.

What is a Centralized Exchange (CEX)?

A Centralized Exchange (CEX) is practically equivalent to conventional financial markets as an arbiter between buyers and sellers. On the platform, its users can perform all of the following critically relevant functions, i.e., money management, order execution, and security. Well-known CEXs include Binance, Coinbase and Kraken.

Key Features of CEX

- User-Friendly Interface: The great majority of CEXs possess interface that are easy to use, hence suitable for novice users.

- Liquidity: Specifically, for the CEXs, the liquidity (higher number of total users, trading) tends to be greater due to the ability to trade quickly to complete trades easily.

- Customer Support: CEXs provide help, which can be exploited to accelerate diagnosis.

Quantifiable Metrics for CEX

- Trading Volume: In 2023, the average daily trading volume of Binance reached $20 billion, the highest in the world for a CEX.

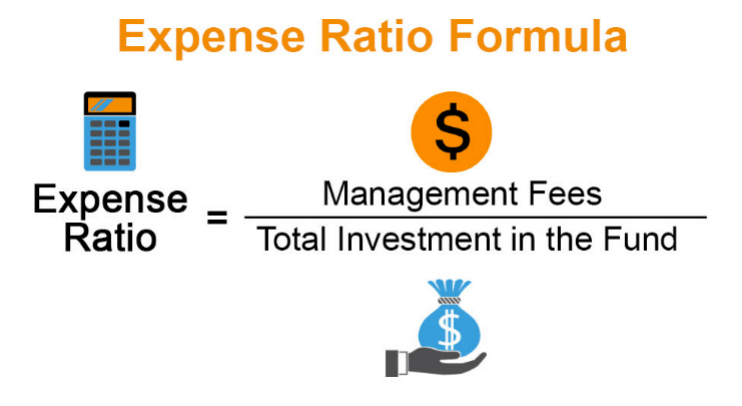

- Fees: Nearly all of the CEXs deduct a fee of 0.1% to 0.5% per transaction, and it can be different between the platforms, and it can be different between each trader.

What is a Decentralized Exchange (DEX)?

A standard Decentralized Exchange (DEX) has the property of the non-mediation, i.e., the point-to-point trading between the users' wallets without an intermediary. Popular DEXs include Uniswap, SushiSwap, and PancakeSwap. Transactions take place via smart contracts and at the same time transparency is made possible and third party trust relationships may be alleviated.

Key Features of DEX

- Full Control of Funds: Users retain full custody of their own private keys, their capital, and hence are free from the risk of centralized theft.

- Anonymity: Not only that it is possible to make a service attractive to users who value privacy without identity-based authentication, it is also possible to make a service attractive to users who value privacy by, for example, minimizing the collection of user data.

- Permissionless Access: Trading is possible all around the world in the internet space and for all the members of the internet society who have a crypto wallet.

Quantifiable Metrics for DEX

Growth in Adoption: DEXs traded more than 341 million in 2020.

Lower Fees: DEX transaction fees are typically from 0.01% to 0.3%, which are influenced by the network congestion and the platform.

Advantages of CEX

- High Liquidity: In general, the liquidity pools of CEXs are relatively deep, so orders are readily executed smoothly. Example, when the market is very volatile, Binance carries out millions of transactions per second in order to avoid price slippage.

- Enhanced User Support: Customer support is provided to the inexperienced all the time on CEX platforms, and hence support is simple to obtain. Because COINBASE is a 24/h Customer Service company, COINBASE provides quality service to its users.

- Fiat Integration: Many CEXs offer trading between cryptocurrencies and fiat currencies, namely the user is able to have cryptocurrencies converted into fiat currency (US dollar or euro, for instance).

Advantages of DEX

- Security and Ownership: Money control is reinforced, and exchange poisoning is reduced. On the other hand, centralized platforms have left billions of dollars in the pockets of cybercriminals, e.g., Mt. Gox hack in 2014, where 850,000 BTC were stolen.

- Lower Fees: DEXs generally have lower fees because they eliminate intermediaries. In particular, trading on Uniswap commonly results in a gas charge around 0.05% to 0.3% per trade due to network congestion.

- Censorship Resistance: DEXs are free and hence attractive to people living in countries with restrictive financial control. In contrast to CEXs, which are capable of binding an account, DEXs, that enable users to freely trade across borders.

Challenges of Using DEX and CEX

- CEX Challenges

- Centralized Risks: Users face risks like platform insolvency or security breaches.

- Higher Fees: Transaction fees can accumulate, especially for frequent traders.

- Regulatory Scrutiny: Potential authorities could adopt stricter laws and, as a consequence, exert an indirect influence on the user's privacy and accessibility.

- DEX Challenges

- User Complexity: For instance, DEXs are technical and require specifications such as wallet management and computation gas fee calculation.

- Slower Trade Execution: Due to a liquidity crisis, U.S. users can find their money being delayed or experience price slippage.

- Smart Contract Risks: Although it may be possible to carry out transactions through the use of smart contracts, financial loss may be incurred by way of error or security fault.

Which One is Right for You?

The choice between DEX and CEX depends on your requirements:

Due to the facility of the index in addition to consumer support, CEX should be selected at the top of the selection list if facility and consumer support are at the beginning of the selection list. Insecurity and privacy top of mind, the most likely is to provide them, a DEX. Both types of exchange have positive and negative features, so a multi-mechanistic strategy should be used, i.e., all of them should be used, as possible.

DEX or CEX: The Way Forward

Hence, it is essential to determine the distinction between DEX and CEX before making decisions on cryptocurrencies investment. Even though both CEXs and DEXs have some advantage, that can be convenience and liquidity, it is something to be protected and private for the latter. Therefore, because investors will be able to evaluate the pros and cons of the platforms and because this is one of the best platforms for their trading aspiration under the trading environment they can operate, they will eventually select one platform over the other.