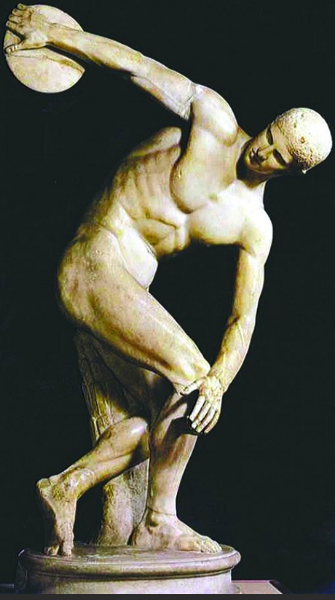

What is an art fund? We all know that art has a high collection value. Generally speaking, both sides of the art transaction belong to the rich with high income at the social level. To a certain extent, they no longer lack the material base and common commodities. The rich realize spiritual enjoyment and harvest by trading artworks.

As a result, the art fund was born in the era of a large number of art transactions.

The art fund is generally composed of three parts. They are portfolio art investment mode, trust investment mode and hedge investment mode.

Among them, the first mode is the most common. Its principle is that investors will invest the funds raised in the works of art. These works of art often come from different periods and are of various kinds. To take a simple example, some war collections and modern collections are in the charge of fund managers, who cooperate with art consultants and experts to finally determine the investment amount of different artworks.

After the initial establishment of the fund, some foundations developed these art collections into their own fund projects by purchasing them. At the same time, the Foundation will invest a large amount of money in publicity to increase the price of these art funds. Some foundations even provide the investment of these artworks as a kind of securities for investors to buy equity.

After introducing the objects for sale, we will now focus on the people who buy these art funds.

The investors of art funds are usually individuals or large companies with large wealth. Only these very rich high-income people can be qualified and confident to buy art funds. It is worth mentioning that investors can not only invest in the art itself, but also invest in the creators, namely artists. The works of artists will be reserved in advance and distributed as a fund in the future.

For artists, the establishment of the Artwork Fund is also good news. Artists only need to provide high-quality works of art for the Foundation on time to obtain benefits. The Foundation provides artists with trust pension services. Artists can quickly obtain income and share future value-added income of their works.

In addition, the Artwork Foundation can ensure the fluidity and reliability of artworks, so that artworks can be traded well in a short time. At the same time, the foundation does not need much cost to maintain and operate, as long as the publicity work is done well, it can get a lot of attention.

Compared with other types of fund forms, art hedge fund is a new model. One of the characteristics of this model is to reduce investment risk through hedging investment. It pays special attention to stocks related to the art market.

The art fund market is an important component. Global art investment funds have different levels of development and characteristics in different regions. In recent years, China's art funds have gradually standardized, while European and American art funds focus on details and services.